👛 CFPB Reports on BNPL

- Frank Tian

- Sep 18, 2022

- 2 min read

Updated: Sep 26, 2022

Here is a summary with some highlighted numbers.

🔲 The Data

In Dec 2021, CFPB asked for data from 5 major BNPL operators in the US: Affirm, Afterpay, Klarna, PayPal, and Zip.

Yesterday the agency released an 80+ page report based on the aggregated data. No consumer-level data was available.

🔲 The Stats

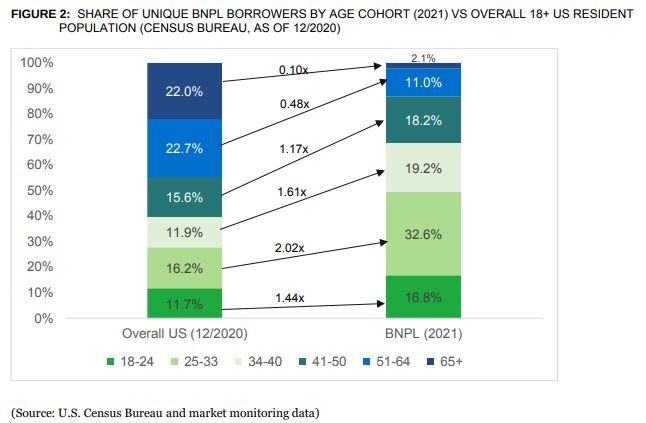

◾ BNPL customers are skewed to the young: 49% are age 33 and under.

◾ Apparel and beauty is the biggest category: 59% of the total $ spent.

◾ Majority payment is from the debit card: 89% vs 10% from a credit card.

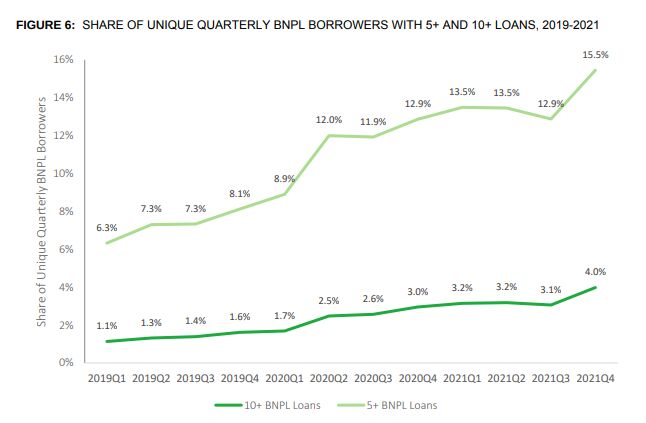

◾ Habitual users: 15.5% carrying 5+ loans; 4.0% carrying 10+ loans.

◾ Pay Late: 10.5% of borrowers are charged with a 1+ late fee.

🔲 The Profit Model

Using 2021 numbers:

◾ BNPL earns 4.0%~ of total purchase as revenue.

Merchant discount: 2.49%

Interchange: 0.67%

Referral: 0.32%

Late fees: 0.28%

◾ BNPL incurs 3.0%~ of total purchase as cost.

Payment processing: 1.47%

Credit loss: 1.30%

Cost of funds: 0.16%

◾ BNPL earns a profit of 1.0%~ of total purchase.

🔲 The Challenges

Before the regulator is yet to step in:

◾ Competition leads to lower revenue

The low barrier of entry makes merchant discounts a race to the bottom. Then come the heavyweights such as MasterCard Installment/Apple Pay Later.

◾ Increase in cost of fund

The Fed hike the rate by 225 bps already in 2022 … it could go another 150 bps.

◾ Rise of credit loss

Consumer credit loss is gradually normalizing towards the pre-pandemic level: 3.79% in 2021 vs. 2.93% in 2020.

It will become worse if a recession materializes, even a mild one.

🔲 The Actions

The operators have adopted the following:

◾ Hike the late fee

◾ Tighten the underwriting

◾ Turn the app into the lead engine

Full CFPB Report: Buy Now Pay Later Market Trends Consumer Impact 2022

🔹If you enjoy this post, consider receiving content like this in your inbox.

Comments